Budget 2019

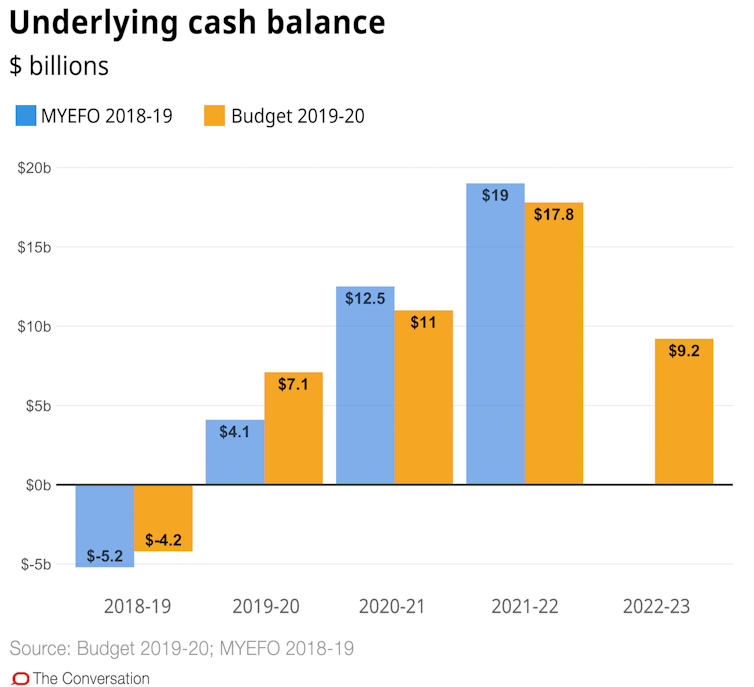

The estimated surplus of A$7.1 billion for 2019-20 will be the first time the budget has entered positive territory since 2007-08.

How will the government spend this unexpected windfall of revenues?

Simplifying the tax system will cost the government $158 billion over the next ten years. The measures include:

- doubling the low and middle income tax offset from $530 to up to $1,080 for people earning up to $126,000, starting from the current 2018-19 financial year

- changing the 32.5% threshold to be $45,001 to $120,000 from 2022-23, with the 19% bracket covering incomes from the tax-free threshold up to $45,000

- reducing the 32.5% tax rate to 30% from 2024-25 onwards, and changing the income thresholds so that the 30% rate applies to all earners from $45,000 to $200,000

- removal of the 37% rate altogether from 2024-25.

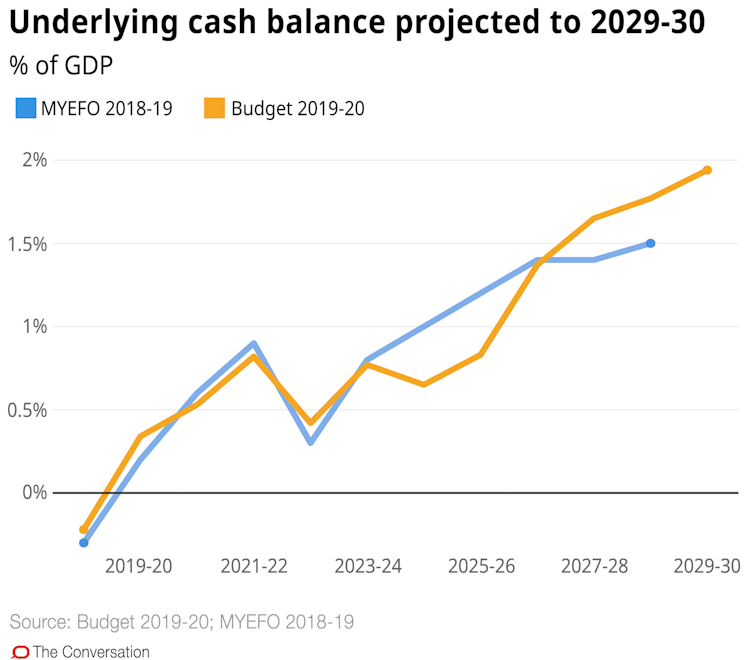

Despite the boost in revenue the government expects to reach its long-term target of surplus being 1% of gross domestic product later than estimated in the December budget update.

The government now expects surplus to exceed 1% of GDP in 2026-27.

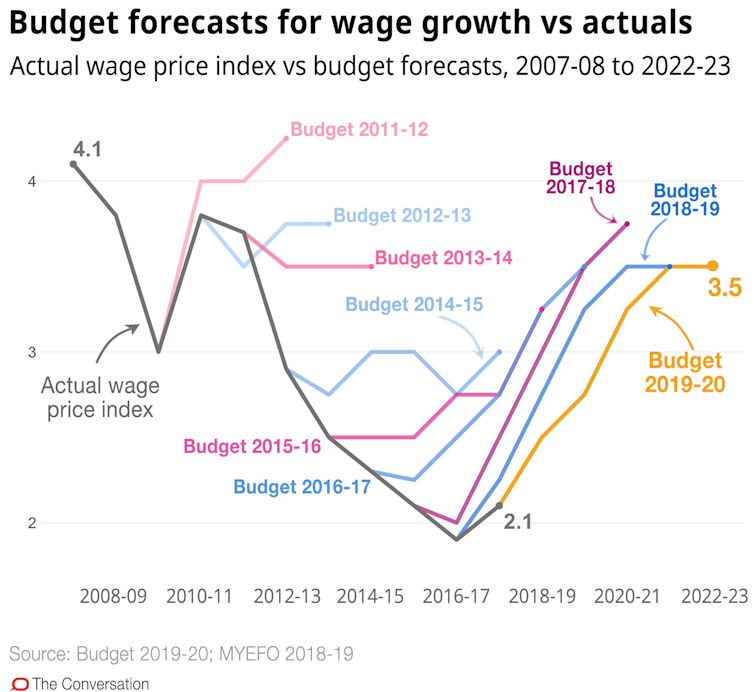

This budget, like many before it, predicts wages to increase over the next four years. The government expects the wage price index to increase from its current 2.1 to 3.5 by 2022-23.

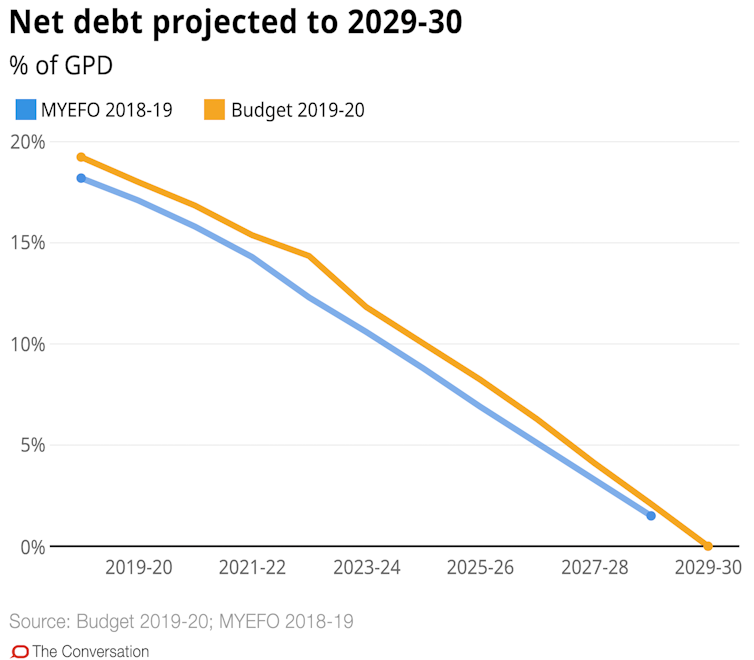

Net debt as a share of the economy is expected to peak in 2018-19 (19.2% of GDP), and will then commence a downward trend until fully eliminated in 2029-30.

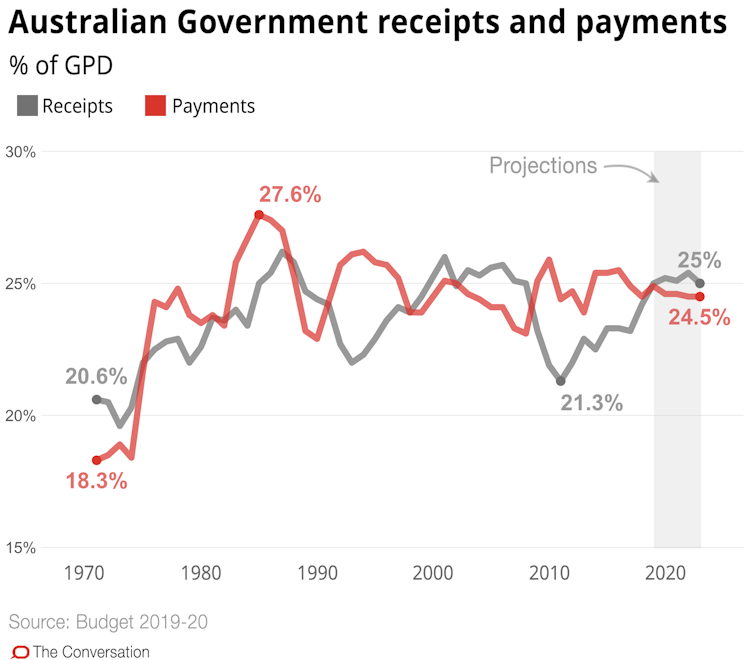

Government receipts are expected to climb from 24.2% of GDP in 2017-18 to 25% by 2022-23. Payments are expected to be 24.5% of GDP in 2022-23.